The Monetary Policy Rate (MoPR) was unchanged at 3.5 percent of the previous week for a paper maturing on 11 March 2026. For the 1-month BoBC paper...

The Bank maintains the capability to analyse all key economic policy issues that impact on the economy of Botswana, including both domestic and international developments.

Financial stability refers to a well-functioning, liquid, solvent and sound financial system that efficiently facilitates payments, pools funds and allocates resources to the most productive sectors of the economy.

The Bank of Botswana (Bank) promotes financial stability in the country through the regulation and supervision of banks and other financial institutions.

The Bank of Botswana has legislative oversight of the National Payments System (NPS) in Botswana which ensures the effective functioning of all processes relating to financial payments and settlements.

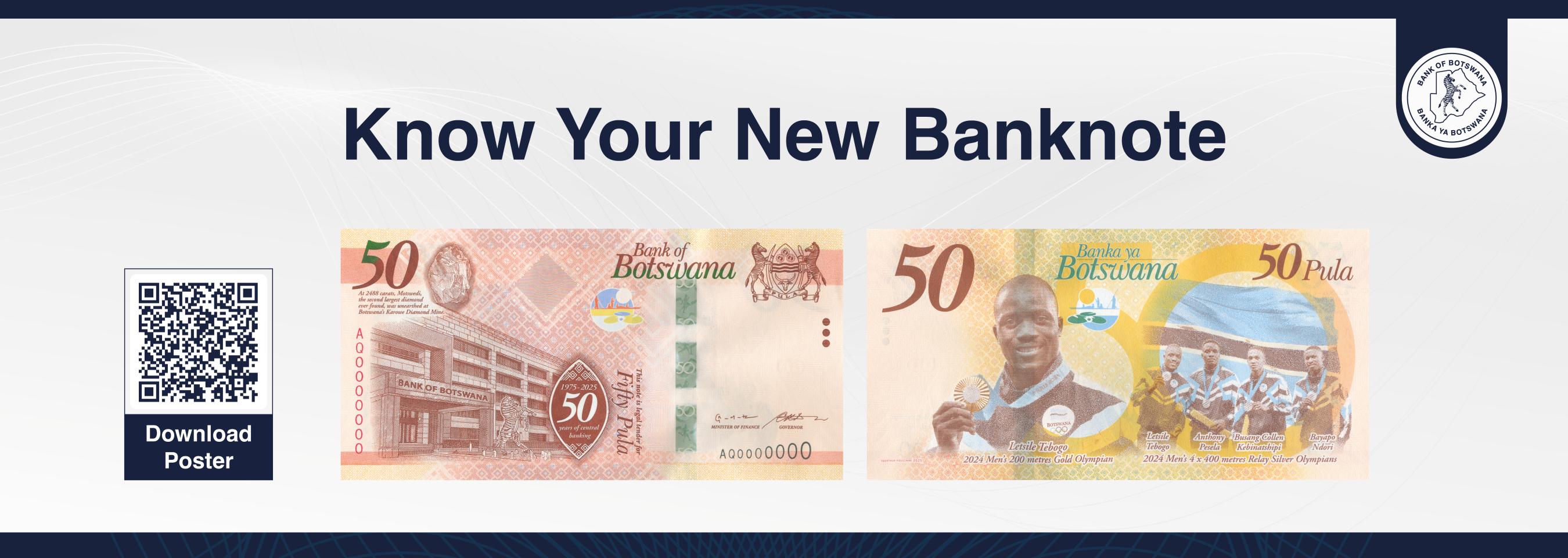

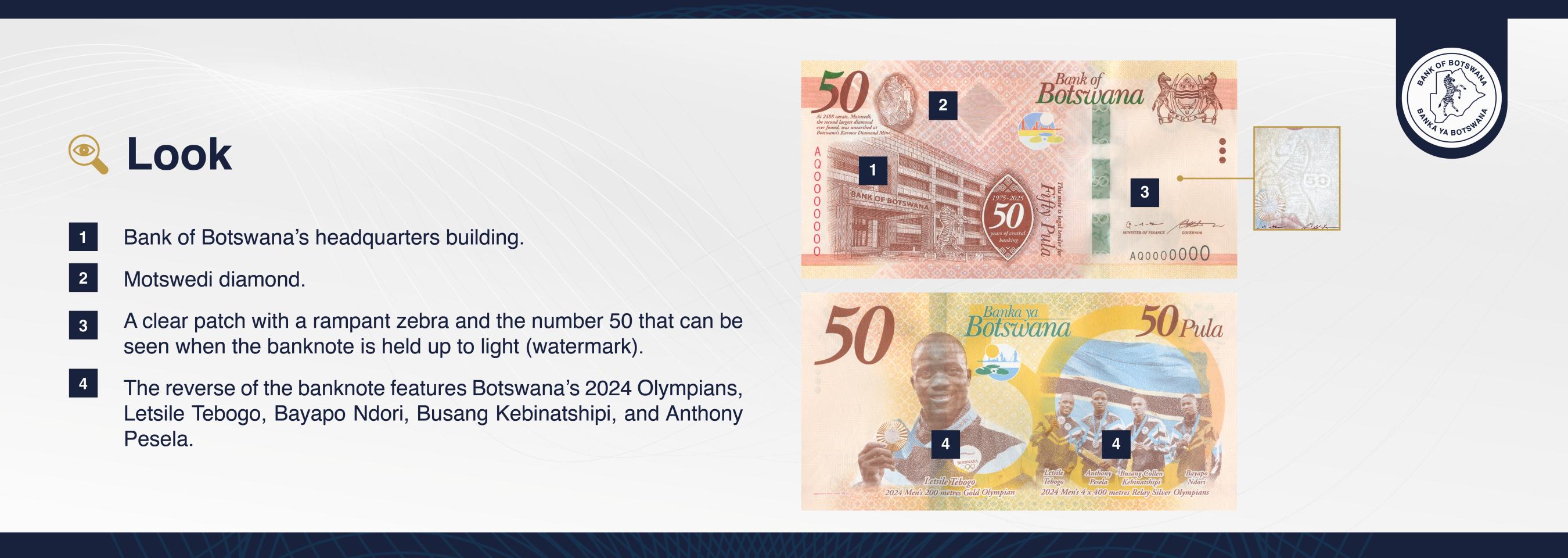

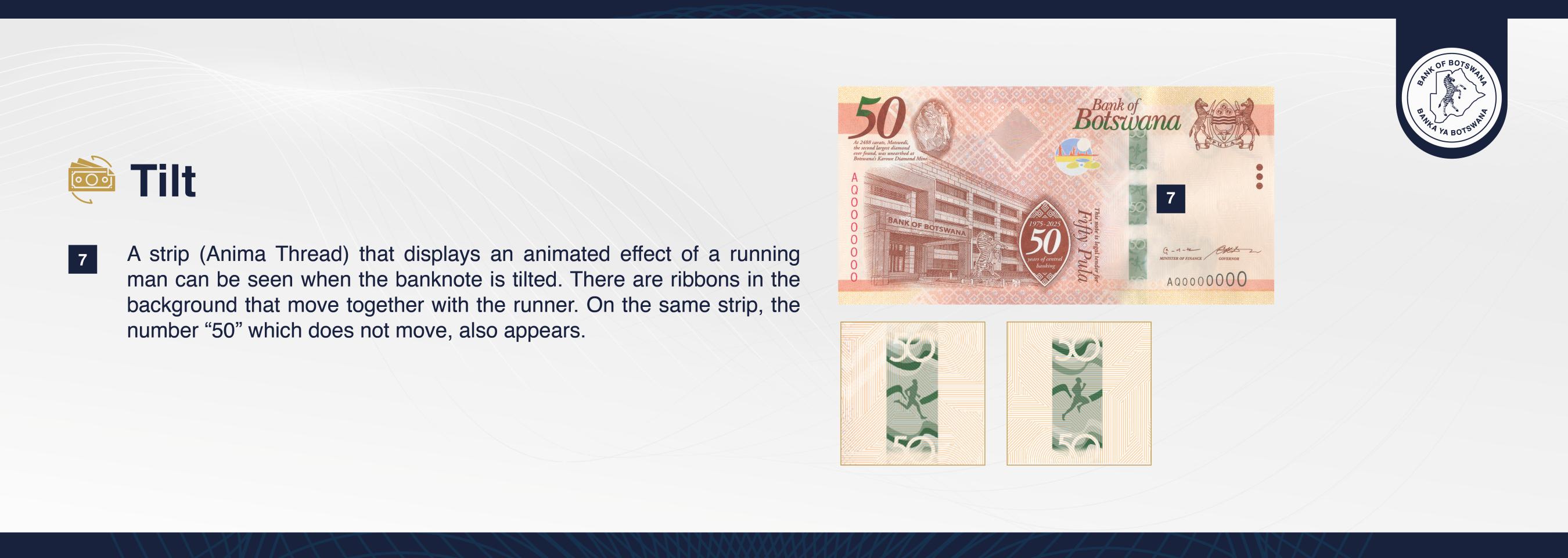

The Bank of Botswana has been issuing currency (notes and coin) since August 1976 when the national currency, the Pula, was first introduced.

The bank of Botswana engages in a variety of operations in domestic financial markets, covering money, bond markets, and foreign exchange markets.